Core Development Cycles

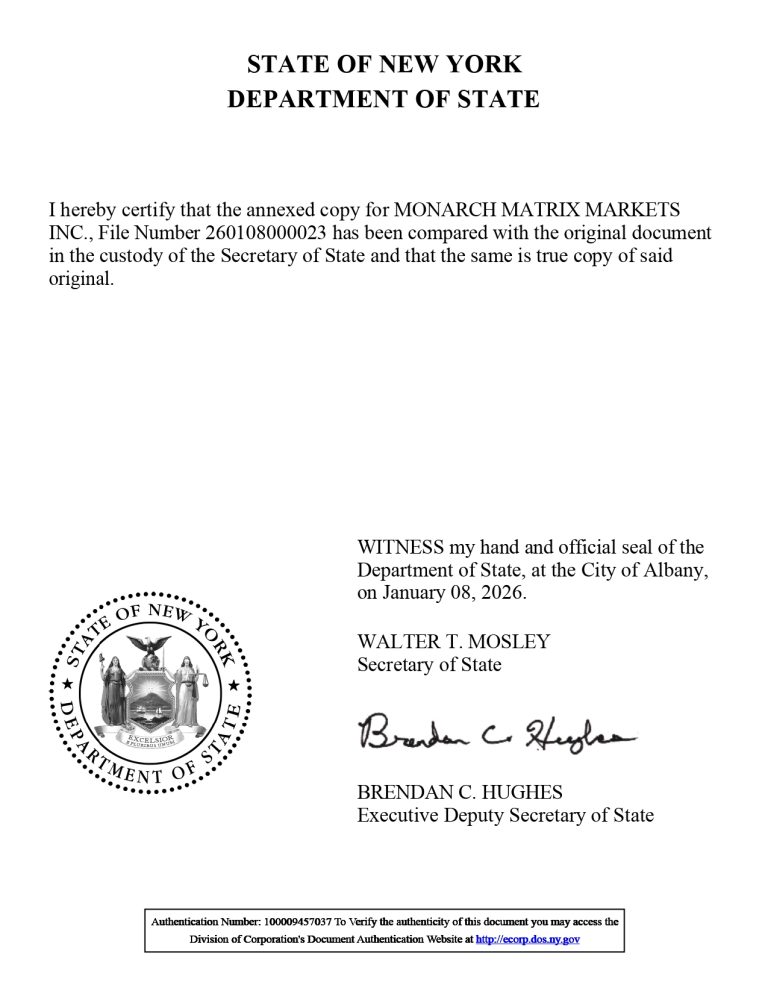

Monarch Matrix Markets Inc is a New York–registered quantitative fintech institution dedicated to the long-term study of global market structure.

Through data-driven research and automated trading systems, we translate complex market behavior into disciplined, repeatable processes designed to operate consistently across market conditions.

Core Development Cycles

System Operation

Core Functional Layers

Distinct Market Regimes Studied

Our approach is built around a clear progression from research understanding to systematic execution.

Rather than reacting to short-term market movement, we focus on developing structured logic and translating it into consistent, repeatable operational behavior.

Market behavior is examined through long-term data analysis, focusing on liquidity, volatility structure, and cross-market relationships rather than isolated signals.

Research insights are translated into explicit rules and parameters, ensuring that assumptions remain testable and operationally clear.

Execution is handled through automated systems designed to follow predefined logic, minimizing emotional influence and discretionary intervention.

All strategies originate from structured research and clearly defined assumptions, ensuring decisions are grounded in analysis rather than opinion.

Automated systems translate research logic into consistent execution, reducing emotional interference and operational inconsistency.

Systems are designed to behave consistently across different volatility regimes and market environments, rather than adapting to short-term performance shifts.

Cross-Regional Market Observation

Market dynamics are studied across major financial regions to understand how regional conditions influence global behavior.

Cross-Asset Structural Analysis

Relationships between asset classes are examined to identify how shifts in one market environment affect others.

Time-Zone Neutral System Design

Systems are designed to operate continuously across time zones, maintaining consistent behavior as global markets transition.